Overview

Prachetas is the Sanskrit word for pre-eminently intelligent or observant.

Prachetas Capital is a private equity fund manager and business advisory that firmly believes in the art of Value Investing, as articulated in the book “The Intelligent Investor”.

Prachetas Capital targets India-centric, technology-driven firms with a clear, growth-driven business model, built on sound commercial principles. We focus on opportunities either addressing the growing potential of the world’s fastest-growing economy or being headquartered here.

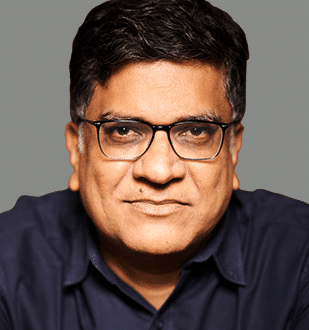

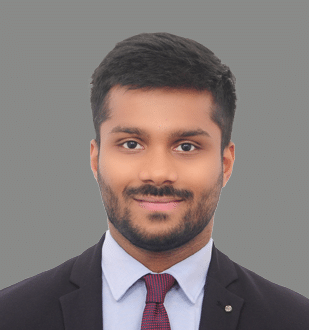

Prachetas Capital is led by a team of astute and pedigreed industry veterans, with considerable global experience and network. We are committed to the task of being a steward, directing our capital and management experience towards sectors with high growth potential.

Our Team

Decades of rich industry experience, deep knowledge, and a global network of resources are the bases that enable us to identify opportunities, attract outstanding entrepreneurs, and partner effectively to drive growth.

Fund

Prachetas New India Growth Fund

- The Fund size is US$ 200 – 250 Million

- Focused on sectors like IT & Digital services, healthcare & pharma, financial services, logistics, and precision manufacturing

- Providing growth capital needs between US$ 15 – 25 Million to meet growth objectives in Small and Medium Enterprises using new technologies with a revenue band ranging between US$ 15 – 150 Million preferably

- Name of the AIF – Agastya Trust

- Scheme Name of the AIF – Prachetas New India Growth Fund

- Registered Address – FLOOR – 3, 310,PLOT NO. 221, MAKER CHAMBER, V JAMNALAL BAJAJ MARG, NARIMAN POINT, Mumbai City, Maharashtra, 400021

- SEBI Registration No. of the AIF – IN/AIF2/21-22/0985

- Investment Manager – Prachetas Capital Pvt. Ltd.

- Registered office of the Investment Manager – FLOOR – 3, 310,PLOT NO. 221, MAKER CHAMBER, V JAMNALAL BAJAJ MARG, NARIMAN POINT, Mumbai City, Maharashtra, 400021

Providing growth capital preferably to first generation entrepreneurs with business models based on strong new technological platforms.

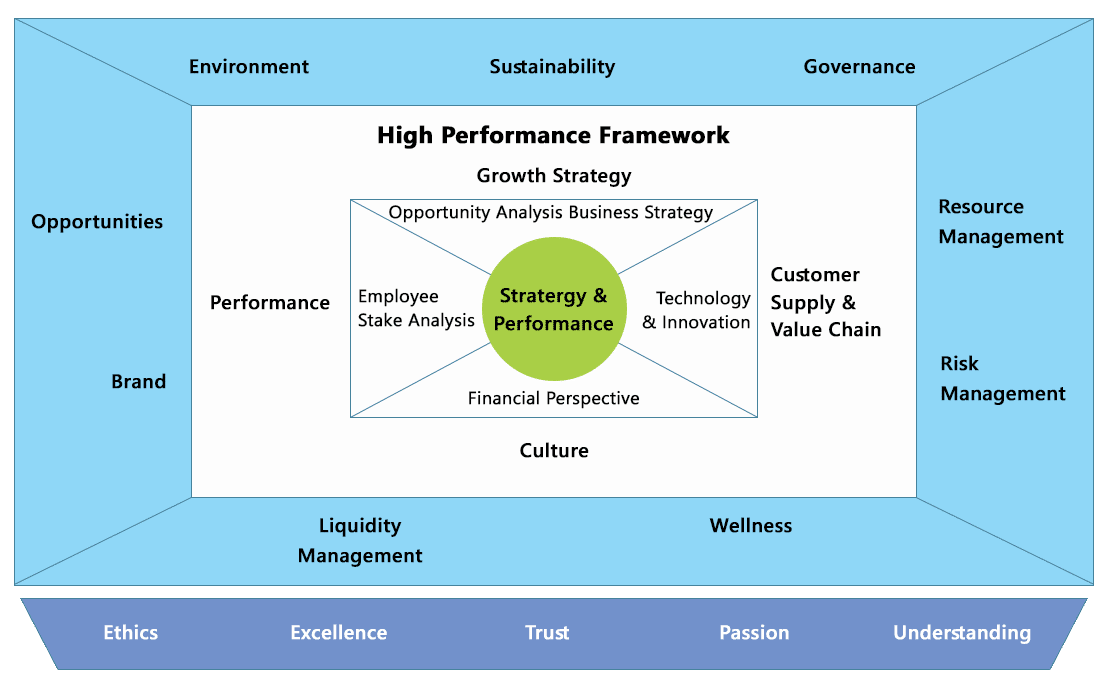

Value Addition

Besides providing growth capital, we draw on our considerable experience and global network to deliver the following

Market access through our global partner network

Strategic inputs to build growth

Mentoring through the business cycle

Help build a high-performance organization