Our Management Philosophy

- We actively seek investment in small and medium-sized enterprises in India, with a strong technology focus and a clear-cut, growth-driven business model.

- We stay engaged as a strong operating investor using our experience and network to help build both sound management and sound corporate governance.

- We are an ethics-first investor, committed to achieving strong financial returns.

- We are always conscious of and meet our social obligations, ever striving to build social capital.

- We constantly pursue excellence, challenging ourselves in a fast-changing world, ever-conscious of both today and tomorrow.

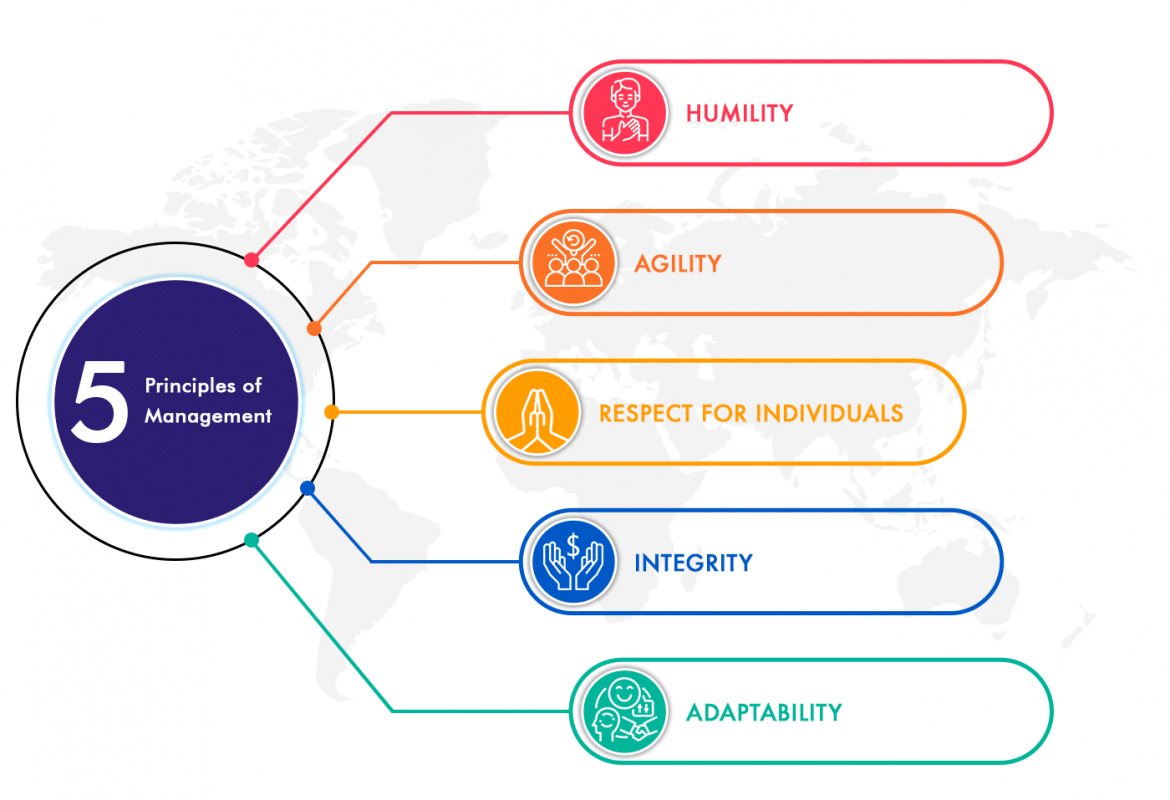

Our Management Philosophy is based on five principles

Our Investment Philosophy

Our Investment Philosophy consist of:

- Ethical Investing

- Responsible Investing

- Value Investing

- Active Investment Management

- Adaptive Investing

Ethical Investing

We will always follow ethical principles while making investments. We will be equitable and fair to organizations or individuals in whose organization we invest.

Responsible Investing

Our investment approach will incorporate Environmental, Social, and Governance (ESG) considerations in our decision-making. The investment team of Prachetas Capital will look at each prospective investment from the point of how it will create impact in clearly defined ESG terms.

Value Investing

We will always approach our investments from a perspective of creating significant value both in the investee company and for investors in Prachetas Capital. The approach would be Intelligent Investing through flexible investment structures, proper due diligence, working out a clear exit strategy at the time of initial investment itself, and through periodic monitoring of such value creation.

Active Investment Management

We will drive growth in our portfolio companies through our continuous involvement. We will provide strong managerial inputs in strategy development and execution in all the key operational areas in our investee companies. We are active investors. We do not believe in being a passive investor. Our team members will, therefore, always have strong operating management and investment management experience.

Adaptive Investing

While our focus will be on making equity investments, we will always flexibly look at alternate structures like convertibles and hybrids and pure debt investment structures with a combination of equity, depending on the need of each investee company. Our approach and goal would be value maximization for both the invested companies and for the investors in the funds.